Monthly Bas Due Dates 2025

Monthly Bas Due Dates 2025. If you are on a monthly cycle your bas due dates for 2025 are. Whether you lodge monthly, quarterly, or annually, our guide.

The payment due date for a tax return is determined by client type, the lodgment due date and when the return is lodged. Get insights on penalties, extensions, and more.

The due date for your monthly bas or ias is the 21st day of the month following the end of the taxable period.

Make BAS Preparation Easier with These TimeSaving Tips Work, For example, a july monthly bas is due on 21 august. Find all the key bas due dates 2025 here.

Estimated Tax Due Dates 2025 Irs Alexa Marlane, Get insights on penalties, extensions, and more. To avoid penalties and interest charges, it is crucial to lodge your statement and make the payment on or before the specified due dates.

![BAS Due Dates [2025 2025] All The Info You Need In 1 Place](https://creditte.com.au/wp-content/uploads/2022/02/BAS-due-dates.jpg)

BAS Due Dates [2025 2025] All The Info You Need In 1 Place, July 2025 information for registered. Due date 28 july 2025.

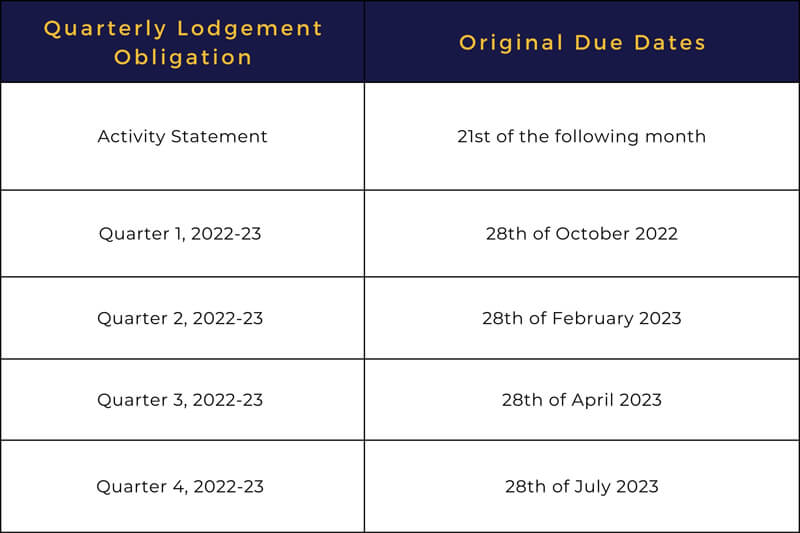

March 2025 Bas Due Date Romy Felicity, There is no extension if you lodge. Quarterly ias/bas lodgement due dates 2025/24.

What Is The Tax Deadline 2025 Sean Velvet, Due date 28 july 2025. Activity statements are produced based on data extracted from our records on these dates.

Term Dates Bourne Academy, If your gst turnover is $20 million or more, you must report and pay gst monthly and lodge. Monthly gst reporting | australian taxation office.

Bas Dates For 2025 Tally Crissie, Quarter 4 (1 april 2025 to 30 june 2025): This is where it gets a little tricky.

Bas Calendar Margi Saraann, Get insights on penalties, extensions, and more. The lodgment program due dates for quarterly activity statements (and december monthly) will now show on your client lists.

BAS Due Dates Guide 2025 for Business Owners TMS Financial, How to lodge your business activity statements (bas) to report and pay your taxes, including gst and payg. Whether you lodge monthly, quarterly, or annually, our guide.

Monthly Bas Due Dates 2025 Kacie Maribel, Due dates for monthly bas/ias the due date for the monthly bas/ias is the 21 st day of the month following the end of the taxable period. This is where it gets a little tricky.

Everything you need to know about bas due date is covered in this article, including deadlines, how it operates, lodging your bas, ways to reduce bas payments,.