Indiana Withholding Rate 2025

Indiana Withholding Rate 2025. Calculate your county tax by year. To estimate your tax return for 2025/25, please select the.

Effective january 1, 2025, allen county will increase its county income tax rate to 0.0159 (currently, 0.0148), blackford county will increase its rate to 0.025. On may 4, 2025, indiana governor eric holcomb approved sb 419, which, effective january 1, 2025, exempts from indiana adjusted gross income compensation received by.

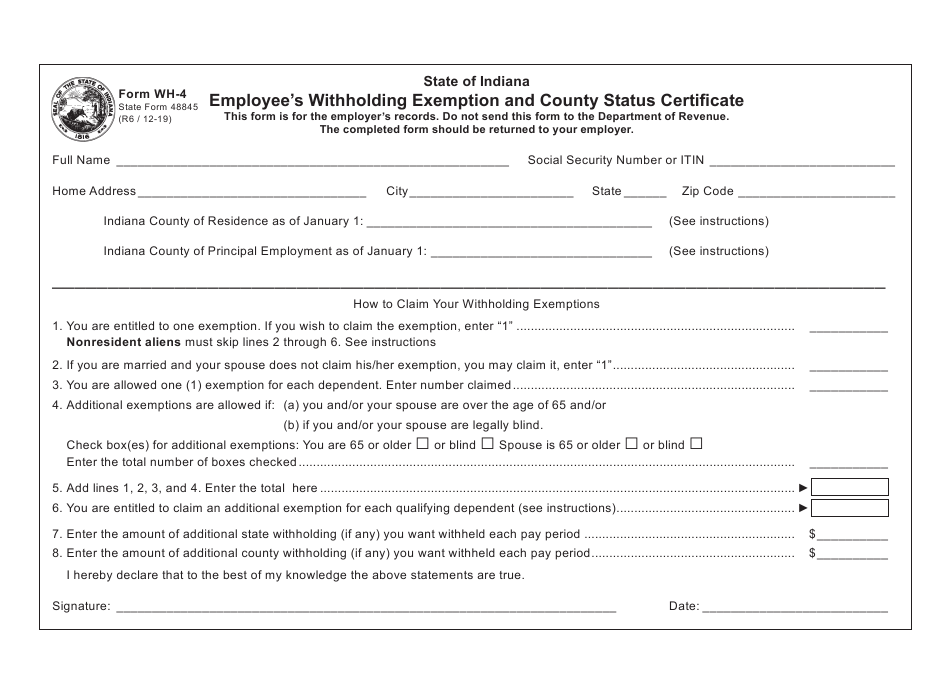

WITHHOLDING ACKNOWLEDGEMENT Indiana · WITHHOLDING, The indiana state tax calculator (ins tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. The indiana tax calculator includes tax.

Indiana Employee Withholding Form 2025, Indiana new employer rate (excluding government and construction): Employers will withhold federal and fica taxes from your paycheck.

Indiana Withholding 20202024 Form Fill Out and Sign Printable, This marginal tax rate means that your immediate additional income will be taxed at this rate. 34 states have 2025 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

Indiana State Tax Withholding Calculator Internal Revenue Code, The indiana individual adjusted gross income tax rate for 2025 is 3.15% and will adjust in 2025 to 3.05%. The additional rate is 0.9%, bringing the total employee medicare withholding above $200,000 to 2.35%.

Did The Federal Withholding Change For 2025 Ilise Leandra, For tax years beginning after december 31, 2025, additional. Updated for 2025 with income tax and social security deductables.

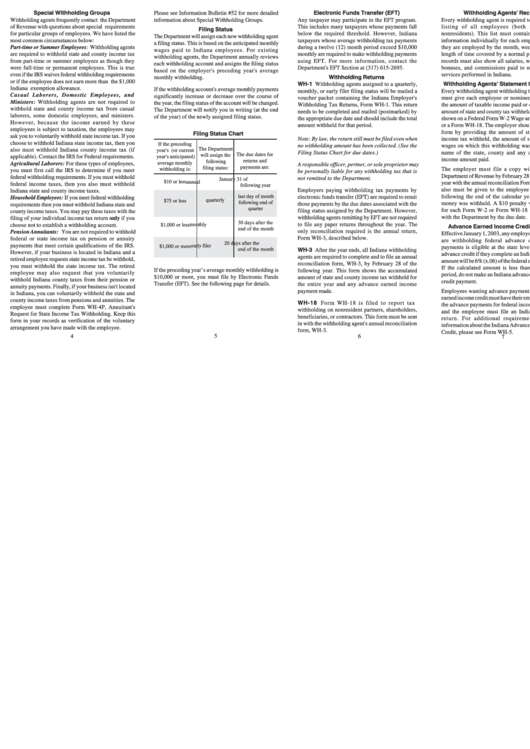

Form Wh13 Withholding Instructions For Indiana State And County, On may 4, 2025, indiana governor eric holcomb approved sb 419, which, effective january 1, 2025, exempts from indiana adjusted gross income compensation received by. Effective january 1, 2025, 13 counties have income tax rate increases and the state withholding tax rate decreased to 3.05%.

Backup Withholding Rate 2025 2025, For tax years beginning after december 31, 2025, additional. Find your pretax deductions, including 401k, flexible account contributions.

Missouri Tax Withholding Tables 2025 Alfi Lottie, The indiana department of revenue (dor) keeps comprehensive records of county tax rates, dating back to 2007. How your indiana paycheck works.

50 Shocking Facts Unveiling Federal Tax Withholding Rates 2025, Employers will withhold federal and fica taxes from your paycheck. The additional rate is 0.9%, bringing the total employee medicare withholding above $200,000 to 2.35%.

Additional Medicare Withholding Rate 2025 Medicare, To estimate your tax return for 2025/25, please select the. The additional rate is 0.9%, bringing the total employee medicare withholding above $200,000 to 2.35%.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

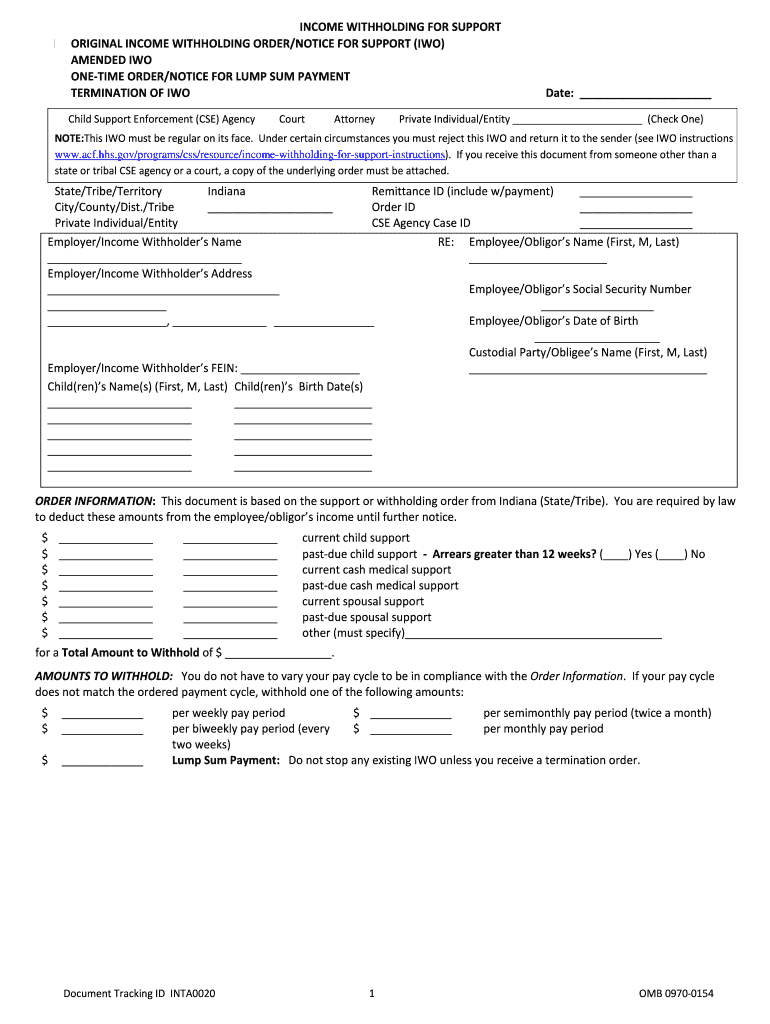

The indiana department of revenue issued updated guidance on how to compute withholding for indiana state and county income tax, reflecting legislation enacted in.