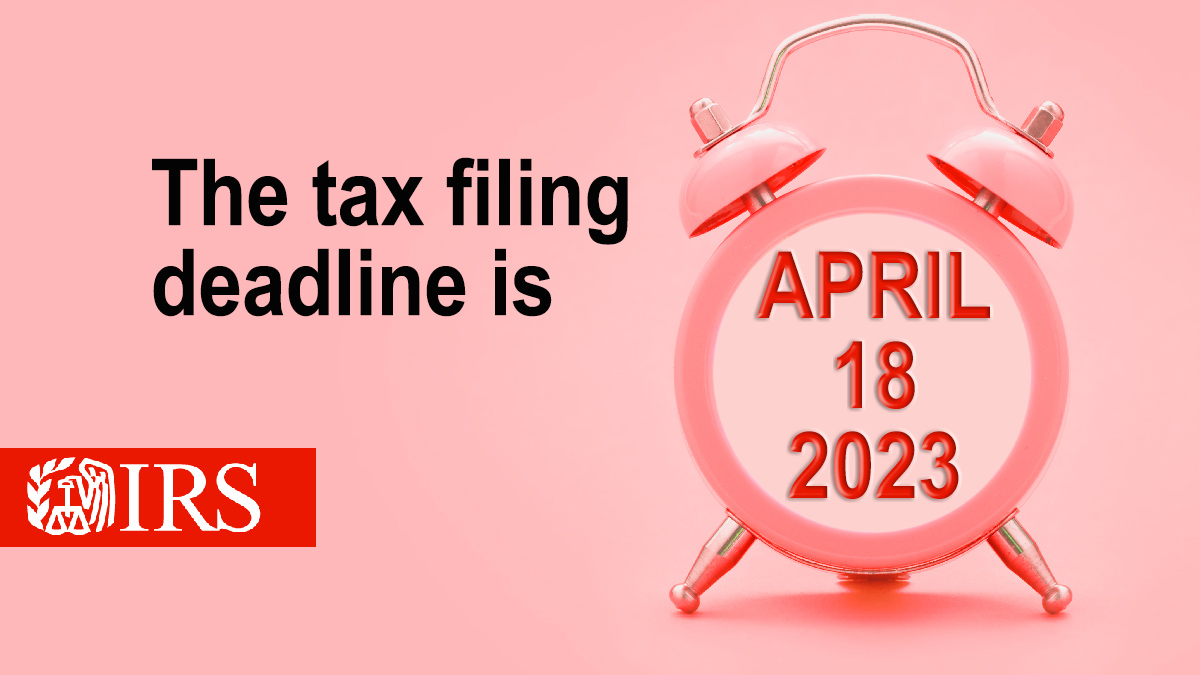

Deadline To File Taxes 2025

Deadline To File Taxes 2025. If you file on paper, you should receive your income tax. Because of the observances of patriot’s.

Taxes Know A Vet, April 15, 2025, is the filing deadline for taxes. It helps that nearly all the returns are being filed electronically this year, which cuts down on paper delays.

Free Tax Filing for 2019 Returns Do you Qualify? What You Need to Know, F ederal tax returns are due monday, 15 april, meaning there is little under a month left to file.as of early march, the irs has reported that the average federal refund being sent is. 15 — an additional six months — to file your return.

Before You File Your Taxes, Here Are 21 Tax Terms You Need To Know, Tax return for seniors, is april 15, 2025. The 2025 tax filing season kicks off.

Tax Finrock Capital, March 26, 2025 7:06 am pt. The filing deadline for the 2025 tax year is april 15, 2025.

Us Tax Deadline 2025 Latest News Update, Tax return for seniors, is april 15, 2025. Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2025 federal income tax.

Deadline File Taxes Should Still Pay Them Keystone Tax Solutions, Updated for tax year 2025. When are taxes due in 2025?

Last date to file Tax Return (ITR) for FY 202223 (AY 202324, Tax return for seniors, is april 15, 2025. The due date for filing your tax return is typically april 15 if you’re a calendar year filer.

NEWSLETTER April 2025 TriLakes Services, Inc., 15 — an additional six months — to file your return. Second estimated tax payment for 2025 due.

Deadline to File Taxes 2025 2025 Tax TaxUni, For 2025 tax filings, the deadline is march 15, 2025. The agency expects more than 128 million returns to be filed before the official tax deadline on april 15, 2025.

Can You File Taxes After The Deadline?, The irs begins accepting tax year 2025 returns on jan. The agency expects more than 128 million returns to be filed before the official tax deadline on april 15, 2025.

Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain.